Did you know that California’s budget shortage, projected earlier this year to exceed $38 billion, may worsen? Recently, a bulletin from Governor Gavin Newsom’s finance department showed that California’s tax revenues aren’t what was expected. This poses another challenge for legislators as they try to create a new and balanced budget.

In March 2024, the same finance department noted that tax revenues were $5.8 billion—or 4% below the projected figures. Personal income tax receipts also accounted for a huge chunk of this shortfall.

This is particularly true with collections down $4.7 billion compared to forecasts, leading to a $3.4 billion revenue gap. Moreover, corporate tax receipts were reduced by $1.4 billion.

California’s Economic Overview: Income Growth and Budget Deficit

According to the California finance department, personal income in the state grew by 4.2% last year. This is an improvement, as there was a 0.2% decline in 2022. Still, the growth wasn’t enough. In fact, this growth lagged behind the national average of 5.2% for the same period.

Economists measure inflation’s impact using the headline inflation rate. Notably, the headline inflation rate is usually derived from the Consumer Price Index released monthly by the Bureau of Labor Statistics. Based on yearly comparisons, headline inflation decreased from 3.5% in December 2023 to 3.3% in February 2024—of course, in California.

ALSO READ: Texas Law Sets Precedent for Controversial Legislation Across Multiple States

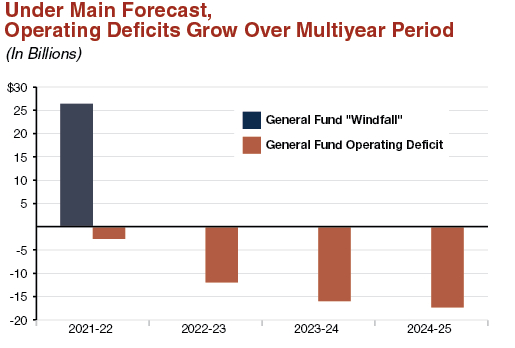

Notably, the finance department highlighted the news concerning California’s budget. While Gov. Gavin Newsom initially estimated a $38 billion deficit, other projections suggest it could be more. More as in worse!! Initially, the Los Angeles Analyst’s Office projected a shortage of around $58 billion. However, in February, the estimate was revised to $73 billion.

California’s Budget Went From Surplus to Deficit

California’s budget situation has changed dramatically in a short period. In 2022, Governor Gavin Newsom approved a $301 billion budget with a $97 billion surplus, which was three times larger than the previous year’s expenditures.

At that time, Newsom felt like the state could afford it. However, economic challenges and declining tax revenues have since led to an unforeseen budget deficit. As mentioned, legislators seek solutions to lessen the projected budget deficit.

Earlier this month, Newsom and the state legislature agreed to cut the deficit by $17 billion. But many of these reductions involved relatively easy cuts or slowed spending, leaving the more substantial challenge of addressing the total deficit volume ahead.

Trick Solutions for the Budget Deficit and Population Decline

Assembly Vice Chair of the Budget Committee Vince Fong criticized the recent deficit reduction deal. He called it a reliance on “budget gimmicks, cause shifts, and deferrals.” Furthermore, when interviewed on Fox News, he argued that these measures are unsatisfactory, pointing to a more serious issue of overspending in the state.

ALSO READ: Legal Trouble for American Couple Over Ammo Possession in Turks and Caicos

Despite ongoing political fights about the budget, California is experiencing another issue—a significant demographic shift. Notably, the state’s population declined in 2020 for the first time on record. From 2020 to 2022, over half a million old residents left California, significantly outpacing the number of new residents.

However, according to Politico, California has recently increased its population for the first time. As it stands now, the state is experiencing a net loss of residents to other states. This recent population issue is due to a decline in COVID-19 deaths and a rise in legal immigration.

Last year, California’s birth rate reached its lowest level in more than a century. The Public Policy Institute of California reported a drop from 2.15 in 2008 to 1.52. With the replacement rate for a stable population considered to be 2.1 children per woman, California’s birth rate is significantly below this threshold.

Where Is California Headed Given the Budget Situation?

The truth is, with the state’s future taxable base, these changes California is experiencing are not good for the future. Moreover, it is still undefined if the debate between the deficit numbers from the LAO tax revenue shortfall and Governor Gavin Newsom will be significant.

So, as the budget negotiations continue, the deadline is fast approaching. Well, that is kind of scary, but no worries! The state legislature will pass a 2024-2025 budget proposal. Since the fiscal year starts on July 1, the proposal will be approved by June 15.

You Might Also Like:

“Jersey Shore” Star Vinny Guadagnino Reveals He “Almost Exclusively” Dates Black Women

Jonathan Majors and Meagan Good Share a Steamy Kiss on California Beach

Sam’s Club Revolutionizes Shopping Experience with AI-Powered Carts

Legal Trouble for American Couple Over Ammo Possession in Turks and Caicos

Colin Farrell’s Journey as a Dad of Two Sons, Including One with Special Needs